haven t filed state taxes in 5 years

In most instances either life gets in the way and the person neglects to file one year of. Where do i even start.

Tax Documents Needed For Marriage Green Card Application

Ad Quickly End IRS State Tax Problems.

. Failure to file or failure to pay tax could also be a crime. This is easiest to do when preparing your federal returns. Filing six years 2014 to 2019 to get into.

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. Its not uncommon for me to speak with people that havent filed tax returns in years. Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for returns due more than three years ago.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing. Theres no penalty for failure to file if youre due a refund. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. I havent filed Arkansas State taxes for at least 10 years. If you fail to file your taxes youll be assessed a failure to file penalty.

After May 17th you will lose the 2018 refund as the statute of limitations. However you can still claim your refund for any returns from. Its too late to claim your refund for returns due more than three years ago.

Answer 1 of 4. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800. Earlier this year the state Legislature and governor agreed to send Californians who file income tax in the state making less than 500000 a year payments between 200.

She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. Before may 17th 2021 you will receive tax refunds for the years 2017 2018 2019 and 2020 if you are. Even if you dont owe the IRS its possible that you may.

Incometax2020 Itr Income Tax Tax Refund Income Tax Return. First of all if you live in a state with its own income tax system you will need to file tax returns for the state as well. I have not filed my taxes since 2018for 2017.

Havent Filed Taxes in 5 Years If You Are Due a Refund. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. That said youll want to contact them as soon as. Contact the CRA.

I would appreciate any help im pretty clueless on. I have not filed my taxes since 2018 for 2017. Roughly 23 million California residents are eligible for the rebate plan which has been set up in three tiers based on the adjusted gross income on your 2020 California state tax.

In many cases some penalties and interest can be waived or abated. There are other important things to remember when you have not filed a tax return in several years. If youre required to file a tax return and you dont file you will have committed a crime.

However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations. Generally the IRS is not interested in going father back than six years but they can if they have reason to.

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Can The Irs Take Or Hold My Refund Yes H R Block

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

What Are 10 Things You Should Know About 1099s

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In 5 Years How Do I Start

When Can You Start Filing Taxes For 2022 U S News

Do I Have To File Taxes In Multiple States

File Taxes Online E File Federal And State Returns 1040 Com

Some States Take Specific Steps To Exempt Covid 19 Payments From Taxation Don T Mess With Taxes

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

What Happens If You Miss The Extended Income Tax Deadline Forbes Advisor

Free Tax Filing See If You Qualify Turbotax Free Edition

2021 Taxes 8 Things To Know Now Charles Schwab

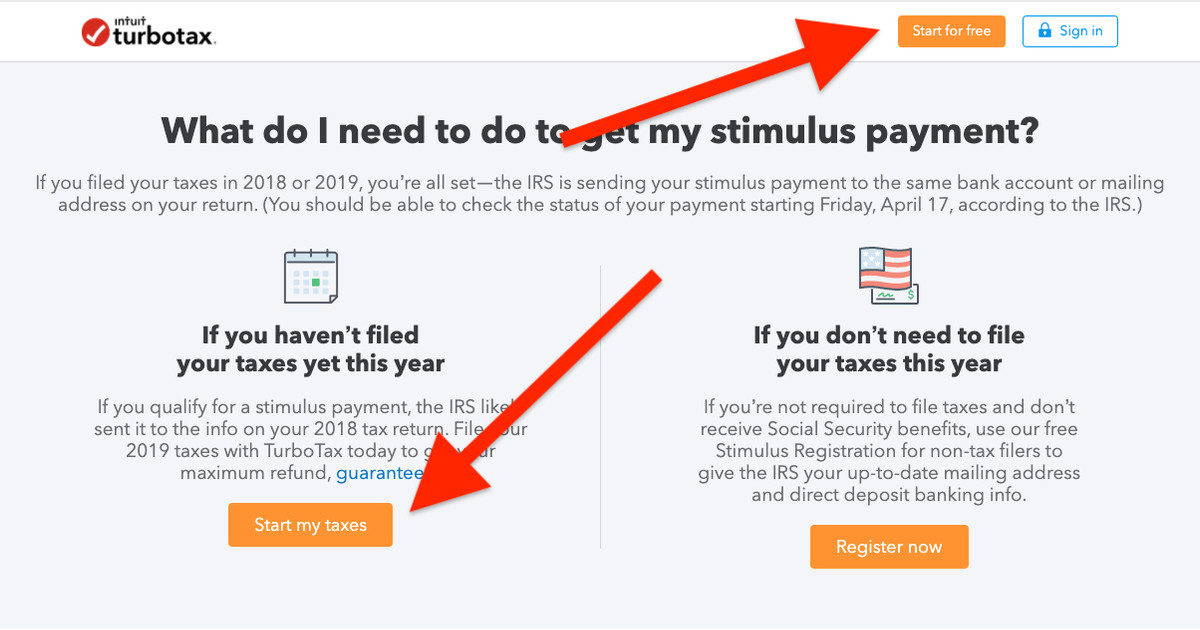

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

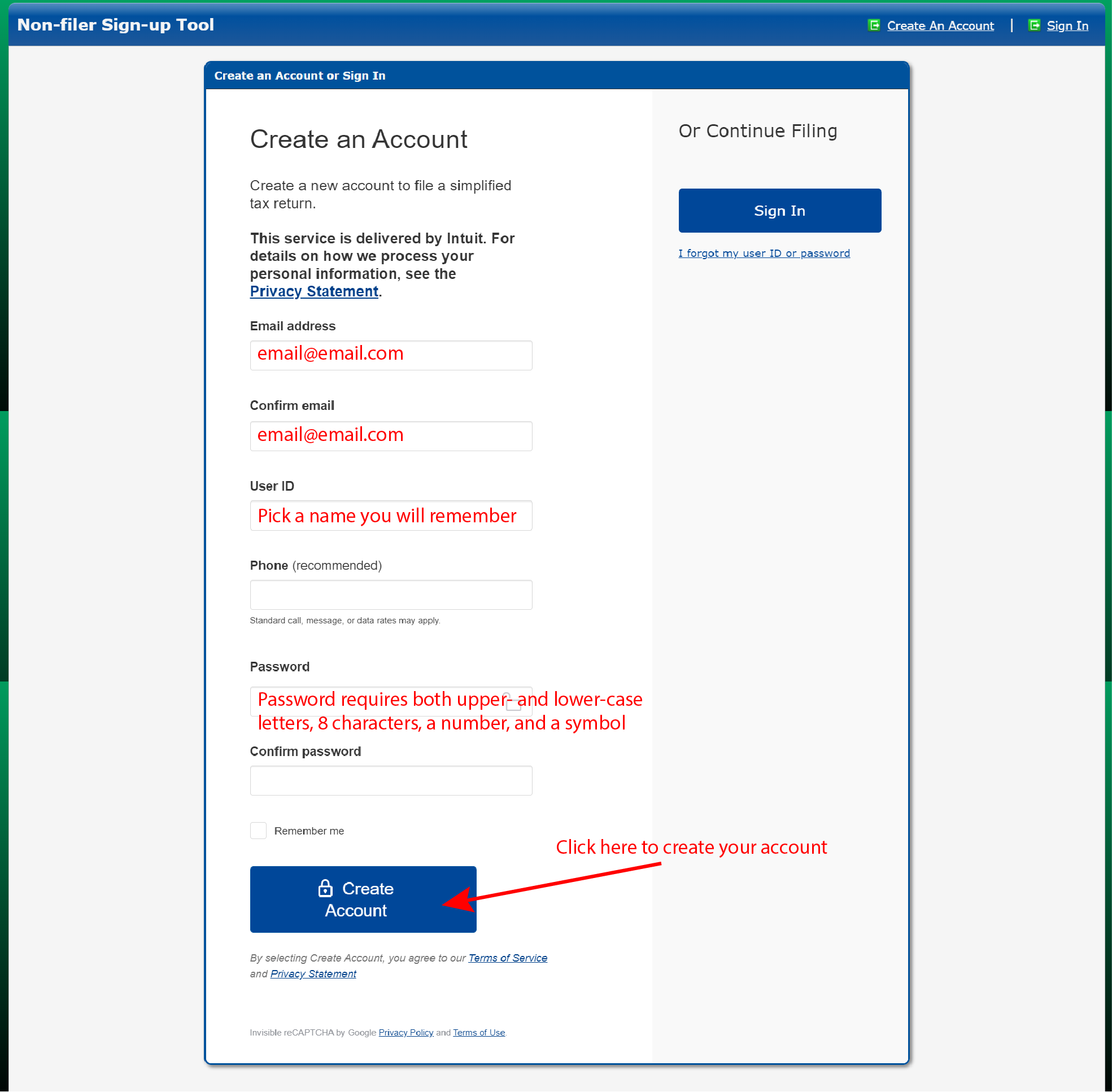

How To Fill Out The Irs Non Filer Form Get It Back

:max_bytes(150000):strip_icc()/Clipboard02-bd341c18e9374c38b085e1efd58d6ba9.jpg)